A strategic business audit is a crucial process for any organization aiming for sustainable growth and success. It provides a comprehensive evaluation of your business’s current standing, identifying strengths, weaknesses, opportunities, and threats (SWOT analysis). This in-depth analysis allows businesses to formulate effective strategies, improve performance, and gain a competitive edge in the market. Conducting a strategic business audit enables informed decision-making, optimized resource allocation, and enhanced operational efficiency.

This article will guide you through the essential steps of conducting a strategic business audit, offering practical insights and actionable advice. Whether you are leading a small startup or a large corporation, understanding the components of a strategic audit, from assessing your internal business environment to analyzing the external market landscape, is essential. Learn how to leverage the power of a strategic business audit to drive business growth, achieve strategic objectives, and ensure long-term business sustainability. By implementing the strategies outlined in this guide, you can unlock the full potential of your business and navigate the complexities of the modern business world with confidence.

What Is a Business Audit?

A business audit is a comprehensive examination of a company’s various aspects, including its financial records, operational processes, and strategic initiatives. It aims to assess the current state of the business, identify areas for improvement, and provide insights for future decision-making.

There are various types of business audits, each focusing on a specific area. For instance, a financial audit examines the accuracy and reliability of financial statements. An operational audit assesses the efficiency and effectiveness of business processes. A compliance audit ensures adherence to regulations and legal requirements.

Audits can be conducted internally by company personnel or externally by independent auditors. Regardless of who conducts the audit, the objective remains the same: to provide an objective evaluation and identify opportunities for growth and optimization.

Purpose of Strategic Audits

A strategic audit serves as a critical assessment of an organization’s current position. It examines internal strengths and weaknesses, as well as external opportunities and threats, to provide a comprehensive understanding of the business environment.

The primary purpose is to identify gaps between the organization’s current strategies and its desired outcomes. This analysis informs future strategic decisions, enabling the company to adapt to market changes and achieve its long-term goals. The audit provides a foundation for developing and refining strategies that capitalize on strengths, address weaknesses, exploit opportunities, and mitigate threats.

Ultimately, a strategic audit aims to enhance organizational effectiveness and improve overall performance by ensuring alignment between the organization’s actions and its strategic objectives.

Evaluating Business Objectives vs Results

This crucial step in the audit process involves comparing established business objectives against actual results achieved. It identifies successes, shortcomings, and areas requiring adjustments. Begin by clearly stating the predetermined objectives. These should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART).

Next, gather the relevant data demonstrating the outcomes. This might include sales figures, market share, customer satisfaction scores, or key performance indicators (KPIs). Present this data clearly, possibly using tables or charts for easy comparison. Analyze any discrepancies between targeted objectives and achieved results. Investigate the underlying causes of these variances. Were the objectives unrealistic, or were there implementation challenges? This analysis provides valuable insights for future strategic planning.

Financial Health and Cash Flow Analysis

This section of the business audit focuses on the financial stability and liquidity of the company. A thorough analysis of financial statements is crucial. This involves reviewing key financial ratios, including profitability, liquidity, and solvency ratios.

Profitability ratios, such as gross profit margin and net profit margin, indicate the company’s ability to generate profits from its operations. Liquidity ratios, like the current ratio and quick ratio, assess the company’s capacity to meet short-term obligations. Solvency ratios, such as the debt-to-equity ratio, measure the company’s long-term financial health and its ability to manage debt.

Cash flow analysis is equally important. Examining the company’s operating, investing, and financing cash flows provides insights into its cash management practices and its ability to generate cash from its core business operations.

Customer Base and Market Position

Analyzing your customer base and market position is crucial for a strategic business audit. This involves understanding your target demographics, their needs, and their purchasing behavior.

Identify your key customer segments. Consider factors such as age, location, income, and purchasing habits. Evaluate your current market share and your position relative to competitors. Determine your strengths and weaknesses compared to the competition.

Understanding your market position helps you identify opportunities for growth and potential threats to your business.

Internal Process Efficiency

Analyzing internal process efficiency is crucial for identifying bottlenecks and areas for improvement within your organization. This involves evaluating the effectiveness and speed of your core operational processes. Key areas to examine include order fulfillment, product development, customer service, and internal communication.

Consider the following questions: How streamlined are your processes? Are there redundant steps? Do processes align with your strategic goals? Identifying inefficiencies can lead to cost savings, improved productivity, and enhanced customer satisfaction.

Technology and Digital Tools Review

This section of the business audit focuses on evaluating the effectiveness of your current technology and digital tools. It’s crucial to determine if your technology supports your business objectives and operational efficiency.

Consider the following areas:

- Customer Relationship Management (CRM) Systems: Assess the functionality and utilization of your CRM for managing customer interactions and data.

- Marketing Automation Platforms: Evaluate the efficiency of your marketing automation tools in streamlining campaigns and lead generation.

- Data Analytics Tools: Determine how effectively you’re leveraging data analytics for informed decision-making.

- Communication and Collaboration Tools: Analyze the impact of your communication platforms on team collaboration and productivity.

- Website and E-commerce Platforms: Evaluate the performance and user experience of your online presence.

Identify any gaps or redundancies in your technology stack. This review should inform strategic investments in upgrades or new tools to optimize business operations.

SWOT Assessment Integration

Integrating a SWOT assessment into your strategic business audit provides crucial insights into your organization’s internal strengths and weaknesses, as well as external opportunities and threats. This analysis forms a cornerstone for effective strategic planning.

Begin by clearly defining the scope of your SWOT analysis. Are you evaluating a specific product, department, or the entire organization? This clarity will focus your data collection and analysis. Next, gather data from various sources, including financial reports, market research, and employee feedback.

Categorize your findings accurately into the four quadrants of the SWOT matrix: Strengths, Weaknesses, Opportunities, and Threats. Prioritize each item within each quadrant based on its potential impact and the feasibility of addressing it. This prioritization will guide the development of strategic actions.

Developing an Actionable Audit Report

A well-structured audit report translates findings into actionable steps. It should clearly present the audit’s scope, methodology, and key findings.

Organize the report logically, starting with an executive summary. Detail specific areas audited, highlighting strengths and weaknesses. For each weakness, propose concrete recommendations with assigned responsibilities and timelines. Prioritize recommendations based on their potential impact and feasibility.

Ensure the report is concise, objective, and uses quantifiable data to support conclusions. A clear and actionable report facilitates strategic decision-making and drives business improvement.

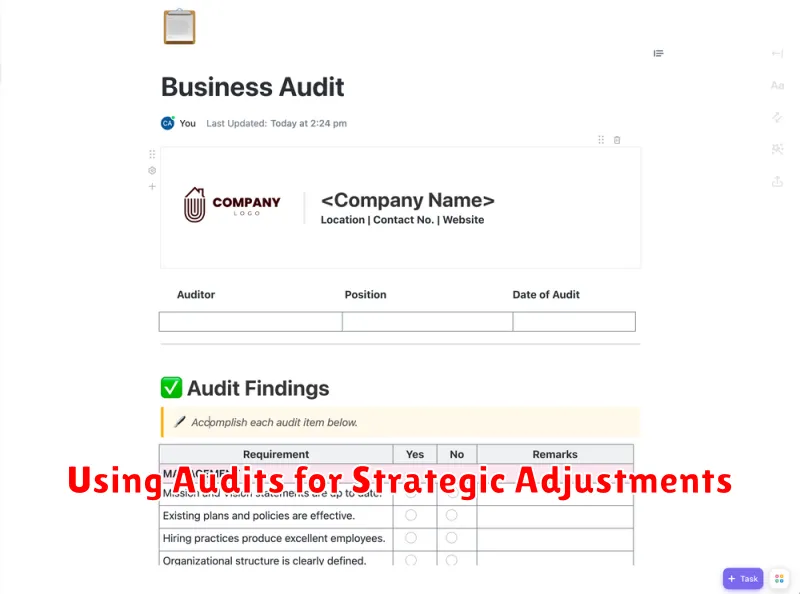

Using Audits for Strategic Adjustments

A strategic business audit provides a wealth of information that can be used to make necessary adjustments to your current strategies. By identifying strengths, weaknesses, opportunities, and threats (SWOT), you can gain a clear understanding of your company’s current position.

Audits can highlight areas where your strategies are underperforming or where new opportunities exist. This data-driven approach allows for informed decision-making and ensures that adjustments are based on concrete evidence rather than assumptions.

Consider the following when using audit data:

- Alignment with goals: Does your current strategy still align with your overall business objectives?

- Resource allocation: Are resources being used effectively and efficiently?

- Competitive landscape: Has the competitive landscape shifted, requiring strategic changes?