In today’s volatile economic climate, revenue diversification is more critical than ever for businesses of all sizes. Relying on a single income stream can leave a company vulnerable to market fluctuations, changing consumer preferences, and unforeseen disruptions. Diversifying revenue streams creates resilience, mitigates risk, and fosters sustainable growth. This article will explore the importance of revenue diversification and provide practical strategies for implementing it effectively within your organization. Understanding the core principles of revenue diversification, including identifying new market opportunities and developing innovative products or services, is key to long-term success and stability.

By strategically expanding your revenue streams, you can create a more robust and adaptable business model. Revenue diversification not only protects against potential losses but also unlocks new growth opportunities. Whether you’re a startup, small business, or established enterprise, learning how to diversify your income is essential for thriving in today’s competitive landscape. This article will guide you through the process of assessing your current revenue model, identifying potential areas for diversification, and implementing strategies to achieve sustainable, long-term growth through revenue diversification.

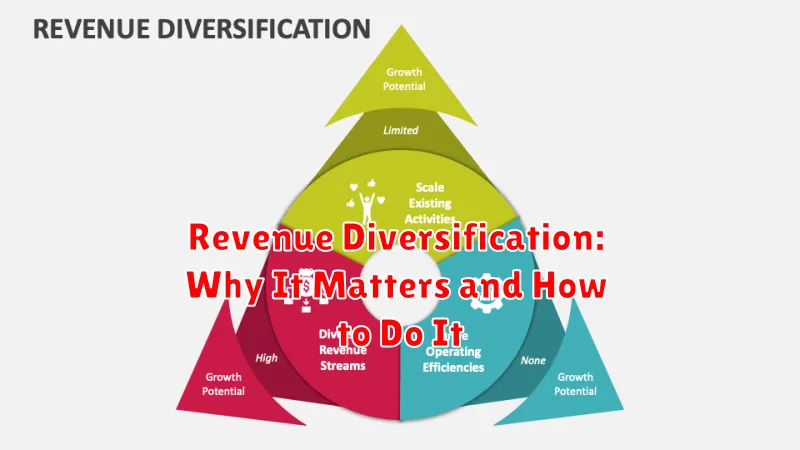

What Is Revenue Diversification?

Revenue diversification is the strategic practice of expanding a business’s income streams beyond a single product, service, or customer segment. Instead of relying heavily on one source, a diversified approach generates revenue from multiple avenues.

This strategy aims to reduce risk. If one revenue stream underperforms or fails entirely, the business can still rely on others to maintain stability and profitability. Diversification can also open up new growth opportunities and improve a company’s overall financial health.

Risks of Relying on One Source

Over-reliance on a single revenue stream exposes businesses to significant risk. If that source diminishes or disappears, the entire business can be jeopardized. This can occur due to various factors, including changes in market demand, the emergence of new competitors, or disruptions in the supply chain.

Concentrating on one revenue source can also lead to stagnant growth. Diversification opens doors to new markets and opportunities, fostering innovation and expansion. Without diversification, businesses may struggle to adapt to evolving market conditions and lose their competitive edge.

Furthermore, relying solely on one source can create financial instability. A downturn in that particular area can severely impact cash flow and profitability, making it difficult to weather economic storms or invest in future growth.

Exploring New Products or Services

Introducing new products or services is a powerful way to diversify revenue streams. This involves careful market research to identify unmet customer needs or emerging trends. Analyzing your existing customer base can reveal potential areas for expansion. Consider what complementary products or services could enhance their experience.

Innovation plays a crucial role. This could involve developing entirely new offerings or enhancing existing ones with new features or functionalities. Think about leveraging existing resources and expertise to create a competitive advantage.

Thorough market testing is essential before a full-scale launch. Gathering feedback from potential customers can help refine the product or service and ensure it aligns with market demands. This minimizes risk and maximizes the potential for success.

Licensing, Subscriptions, and Affiliate Options

Licensing intellectual property, such as trademarks or patents, can generate a consistent revenue stream. This allows others to utilize your assets for a fee, expanding your reach without significant additional effort.

Subscription models offer recurring revenue by providing ongoing value to customers. This can include exclusive content, premium services, or software access, fostering customer loyalty and predictable income.

Affiliate marketing leverages partnerships to promote products or services. By earning a commission on sales generated through your referrals, you tap into new audiences and monetize existing traffic.

Entering New Markets

Expanding into new markets is a key strategy for revenue diversification. It allows businesses to tap into new customer bases and reduce reliance on existing markets. Market research is crucial for identifying promising opportunities. This involves analyzing demographics, consumer behavior, and competitive landscapes.

Several approaches exist for market entry. Exporting products offers a relatively low-risk option. Establishing a local presence through a branch office or subsidiary provides greater control but involves higher investment. Partnerships and joint ventures can offer a balance between risk and control, leveraging local expertise.

Localization is essential for success. Adapting products and marketing messages to resonate with the target market’s cultural nuances can significantly impact adoption rates. Consider language, customs, and local regulations when tailoring your approach.

Partnership and Collaboration Models

Strategic partnerships offer powerful avenues for revenue diversification. Collaborating with businesses that complement your offerings can expose your brand to new customer bases and create synergistic revenue streams.

Consider models like joint ventures, where a new entity is formed to pursue a shared opportunity, or licensing agreements, granting another company the right to use your intellectual property.

Affiliate marketing programs can also drive revenue. By partnering with related businesses who promote your products or services in exchange for a commission, you expand your reach without significant upfront investment.

Cross-Selling and Upselling Strategies

Cross-selling involves suggesting related products or services to a customer who is already purchasing something. For example, offering a phone case to a customer buying a new phone. This strategy capitalizes on existing customer interest to increase the average transaction value.

Upselling, on the other hand, focuses on persuading customers to upgrade their purchase to a higher-value option. This could be offering a customer a larger size of their chosen product for a slightly higher price, or a premium version with additional features. Upselling increases revenue by encouraging customers to spend more on a single item.

Both techniques require a deep understanding of your customer base and their needs. Effective implementation can significantly boost revenue and improve customer lifetime value.

Digital Channels and E-commerce

Expanding into digital channels, particularly e-commerce, offers a significant opportunity for revenue diversification. Establishing an online presence allows businesses to reach a wider customer base, operate 24/7, and gather valuable customer data.

Key considerations include choosing the right e-commerce platform, integrating inventory management systems, and implementing secure payment gateways. Effective digital marketing strategies, such as search engine optimization (SEO) and social media marketing, are crucial for driving traffic and generating sales.

E-commerce offers businesses the flexibility to test new products and pricing strategies quickly and efficiently. It also provides valuable insights into customer behavior, enabling data-driven decision-making for further optimization and growth.

Tracking ROI Across Streams

Tracking return on investment (ROI) across diversified revenue streams is crucial for understanding their individual performance and overall contribution to your business. This involves accurately measuring the profit generated by each stream against the resources invested.

Utilize a consistent methodology for calculating ROI across all streams. This ensures accurate comparisons and informed decision-making regarding resource allocation. Clearly define which costs are attributed to each revenue stream, including marketing, production, and distribution.

Regularly monitor ROI for each stream. This enables you to quickly identify underperforming areas and make necessary adjustments to optimize profitability. Consistent monitoring also helps reveal emerging trends and opportunities for further diversification.

Long-Term Value from Diversification

Diversification offers significant long-term value by building resilience against market fluctuations. Relying heavily on a single revenue stream creates vulnerability. If that stream dries up, the entire business suffers.

A diversified revenue model, however, provides a safety net. If one revenue stream underperforms, others can compensate, maintaining overall financial stability and allowing for continued growth even during challenging times. This stability fosters investor confidence and attracts potential funding opportunities, further contributing to long-term success.